W-8BEN Tax Form (for non-US residents)

Instructions on how to fill out the W-8 tax form for non-US citizens (Europe, UK, Mexico, Russia, China, etc)

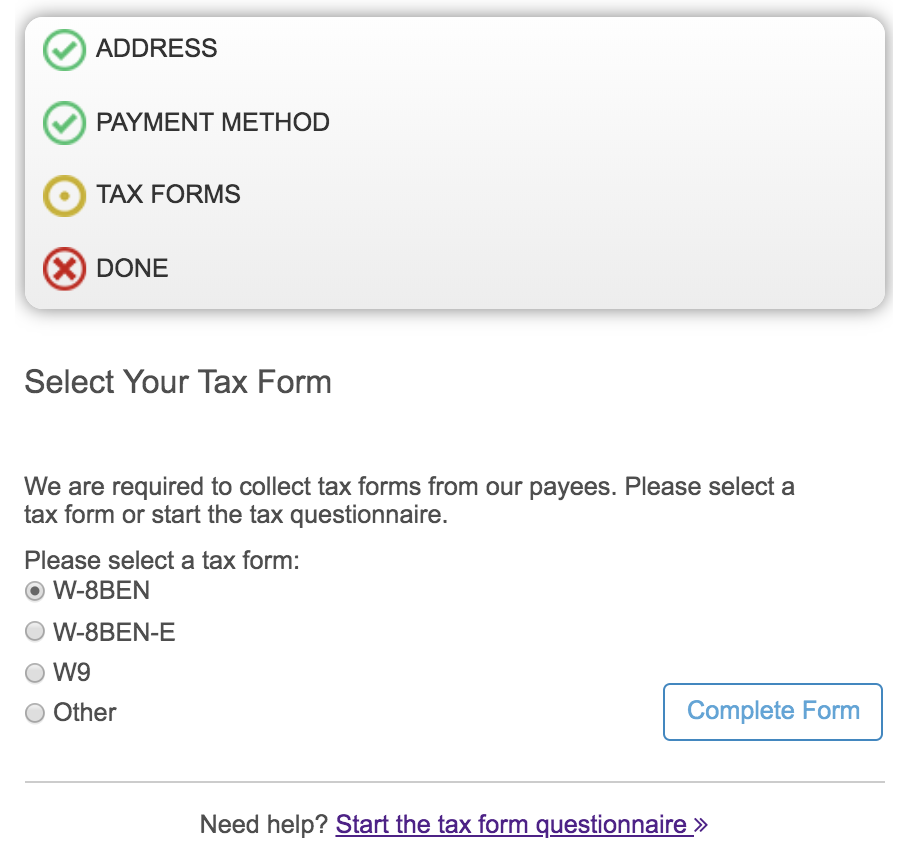

On the Tax Forms page, you will be asked to Select Your Tax Form

Select the W-8BEN circle and click Complete Form.

Part I: Identification of Beneficial Owner

Name — Enter your legally given name as shown on your income tax return. These names need to match the name entered earlier in this form on the Address page.

Country of Citizenship — Enter your country of citizenship.

If you are:

- A dual citizen, enter the country where you are both a citizen and a resident at this time.

- Not a resident in any country in which you have citizenship, enter the country where you were most recently a resident.

- A US citizen, you should complete the W-9 form (even if you hold citizenship in another jurisdiction).

Permanent Residence — Your permanent residence is the address in the country where you claim to live for tax purposes. This will likely be the address where you normally reside.

For Address, include the building number and street name (e.g., "42 Wallaby Way"). For Address 2, include the apartment, suite, unit, building, or floor number.

This address is not required to match the address entered earlier in this form on the Address page, however, you may want to click the "same as contact address" box to autocomplete the form with the information you entered on the first Address page.

Mailing Address — Enter your mailing address only if it is different from your Permanent Residence.

You may want to click the “same as contact address” box to autocomplete the form with the information you entered on the first Address page.

Part I: Identification of Beneficial Owner, Continued

A Foreign Tax Identifying number (FTIN) is required in order to process payments, validate where you are a citizen and to what country you pay taxes. For more information, see our FAQ article: What is a Foreign Tax Identifying Number (FTIN)?

This is REQUIRED to receive payment.

Part II: Claim of Treaty Benefits:

Using the dropdown box, select your Country of Residence. Be sure to check any boxes that appear underneath to ensure you are claiming the correct tax rate. If your country does not appear in this list, please click Continue to move to the next step of the tax form.

Review

Please review the information you entered in the form. Click Continue to finalize the form.

Part III: Certification

Please read through and click all the check boxes so that they are all selected.

Digital Signature — Enter your name exactly as it was entered earlier in this form.

Contact email — This email must match the email entered earlier in this form.

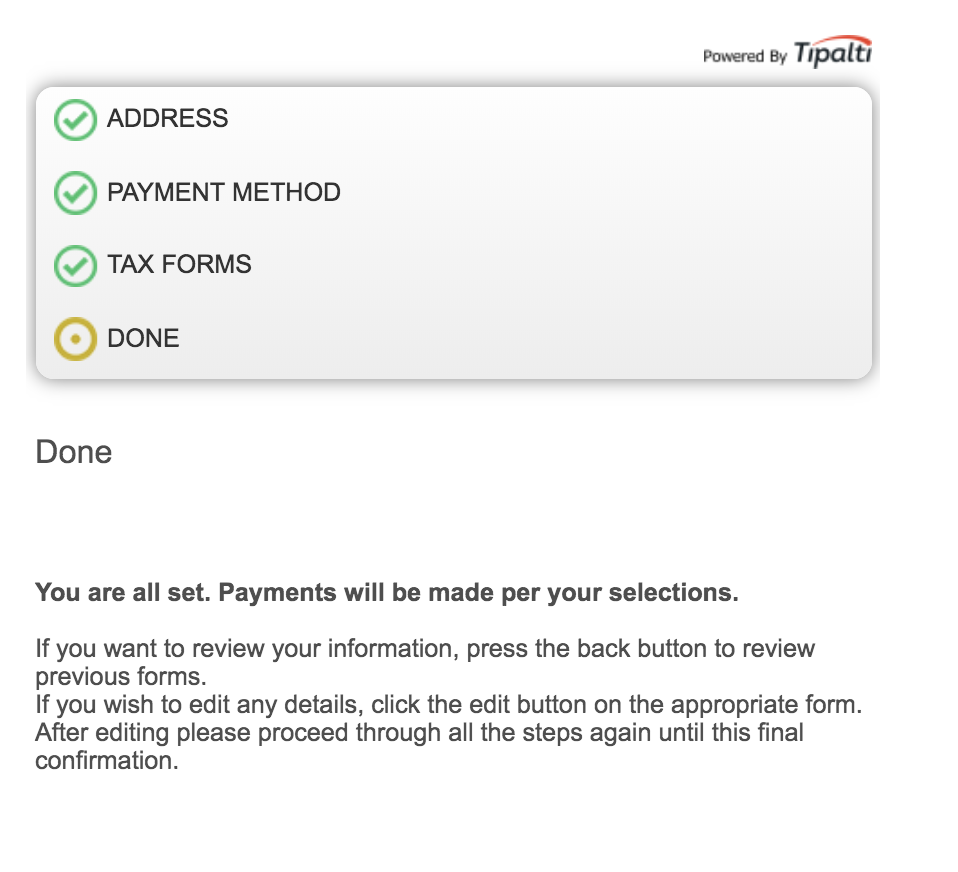

Click Submit Form and you should arrive to the Done page. You are all set. Payments will be made per your selection.

If any information on Form W-8BEN becomes incorrect, please submit a new and updated form.

You can consult the IRS's W-8BEN instructions for non-US based guidance.

![JUKIN_Logo_WHITE-1.png]](https://help.jukinmedia.com/hs-fs/hubfs/JUKIN_Logo_WHITE-1.png?width=120&height=112&name=JUKIN_Logo_WHITE-1.png)