What is a Foreign Tax Identifying Number (FTIN)?

Information on the FTIN number that is required to complete the W-8BEN Tax Form

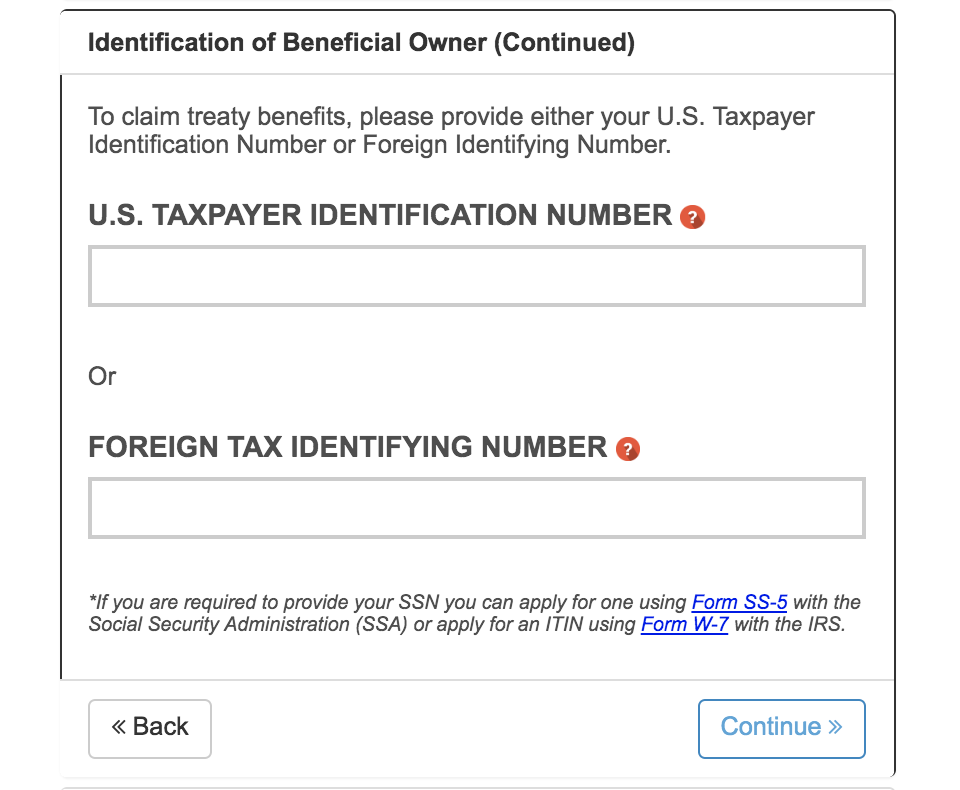

Jukin Media requires a Foreign Tax Identification number (FTIN) in order to validate your tax information. You will not be able to receive payment without entering this number.

Your FTIN will be the unique number that you use to pay taxes or identify yourself in your country. Depending on what country you live in, this number might be on your government-issued identification card or social insurance card. See below for additional examples.

For help completing your international tax form, please see our FAQ article: the W-8BEN (for non-US residents).

Examples of possible Foreign Tax Identifying numbers:

- Canada:

- 9-digit Canadian Social Insurance Number (SIN) issued by Service Canada

- United Kingdom:

-

- National Insurance Number (NINO): a NINO is made up of 2 letters, 6 numbers and a final letter, which is always A, B, C, or D.

- Unique Taxpayer Reference (UTR): 10-digit number

- Brazil

- 11-digit Cadastro de Pessoas Físicas (CPF) attributed to both national and resident taxpayers

- India

- 10-digit Permanent Account Number (PAN)

- Mexico

- 18-digit Clave única de Registro de Población (CURP), unique number issued by the Tax Administration Service

Please note: we are not able to give advice on how or when you should file your taxes. We recommend that you contact a tax professional with any questions.

![JUKIN_Logo_WHITE-1.png]](https://help.jukinmedia.com/hs-fs/hubfs/JUKIN_Logo_WHITE-1.png?width=120&height=112&name=JUKIN_Logo_WHITE-1.png)