Tax Forms

Information on how to complete the Tax Forms section of the Payment Info tab on the Partner Dashboard

In order to comply with U.S. law and for you to receive payment, we need to collect your taxpayer information.

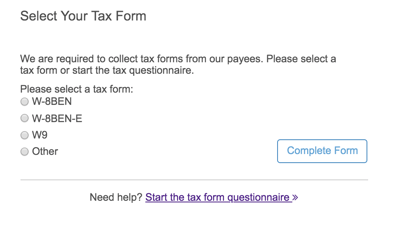

You can find out which tax form to complete by clicking "Start the tax form questionnaire" on the Tax Form page. You may also consult the IRS website for additional guidance on the W-9 and W-8 forms. Generally, U.S. residents will want to complete a W-9 and non-U.S. residents would want to complete the W-8BEN form.

US Tax Payer: W-9 Tax Form

If you are a US taxpayer, you will likely want to submit the W-9. For instructions on completing this form, please see our FAQ article, the W-9 Tax Form (for US taxpayers).

For instructions on how to complete the W-9 form as a Company, LLC, Corporation or Partnership, visit this link.

Non-US Residents: W-8 Tax Form

For non-US residents, you will most likely want to select the W-8BEN. Please see our FAQ article, the W-8BEN Tax Form (for non-US residents), for help completing this form.

![JUKIN_Logo_WHITE-1.png]](https://help.jukinmedia.com/hs-fs/hubfs/JUKIN_Logo_WHITE-1.png?width=120&height=112&name=JUKIN_Logo_WHITE-1.png)