W-9 Tax Form (for US taxpayers)

Instructions on how to fill out the W-9 Tax Form for US Taxpayers

On the Tax Forms page, you will be asked to Select Your Tax Form

Select the W-9 circle and click Complete Form.

Name — Enter your legally given name as shown on your income tax return. These names need to match the name entered earlier in this form on the Address page. If you are filing as a company, please put your company name here.

Business Name / Disregard Entity Name — Unless you are filing as a Company, leave this field empty.

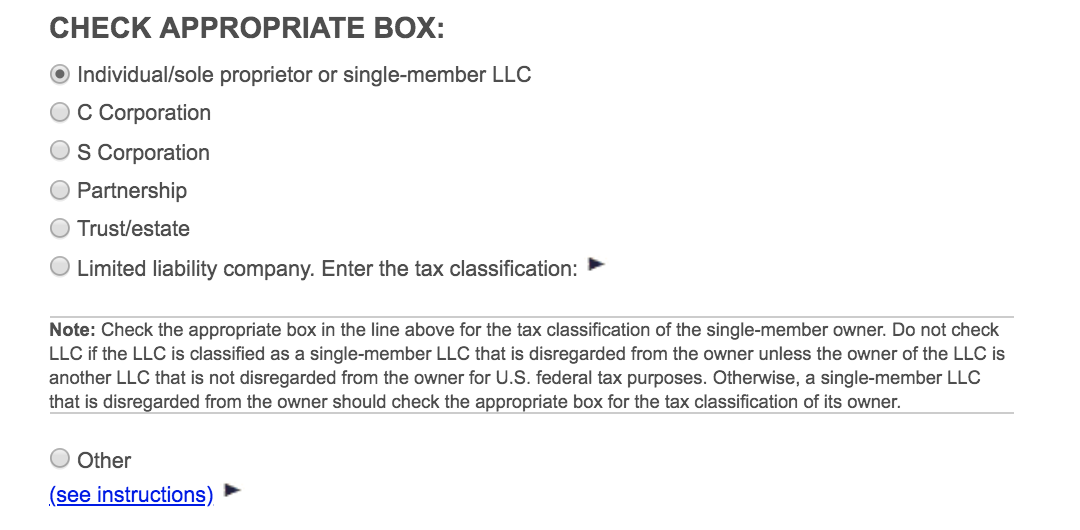

Check Appropriate Box — Unless you are filing as a Company, select the first button “Individual”

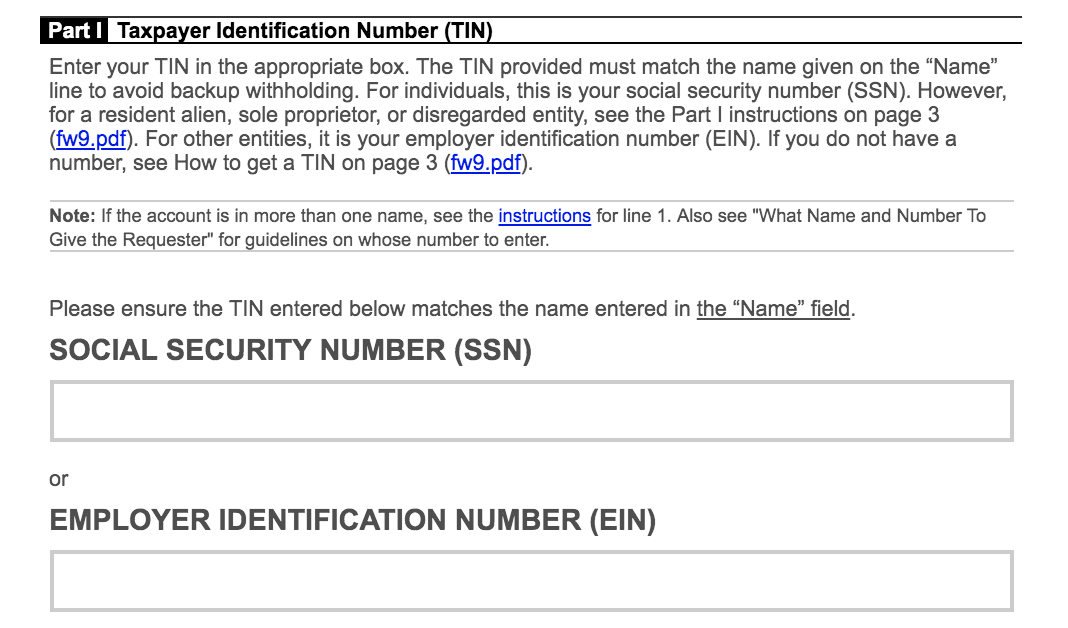

If you select "Individual" please be sure to put your tax number in the Social Security Number box. If you select anything other than "Individual", please be sure to put your tax number in the EIN box.

Exemptions — If applicable, list exemption codes. You will likely not need to enter anything here and can skip this section.

Address — For Address, include the building number and street name (e.g., "42 Wallaby Way"). For Address 2, include the apartment, suite, unit, building, or floor number.

This address does not have to match the one entered on the Address page but you will receive a tax document to this mailing address so please ensure it is up to date.

***If you selected "Individual" earlier, please be sure to put your tax number in the Social Security Number (SSN) box. If you select anything other than "Individual", put your entity tax number in the Employer Identification Number (EIN) box.***

Digital Signature — Enter your legally given name. This name must match the name entered earlier in this form. Please note, this form is case sensitive. For example, if you entered your name on the Address page as "ricky Martin", you must enter it as "ricky Martin" in the Digital Signature.

Contact Email — This email must match the email entered earlier in this form.

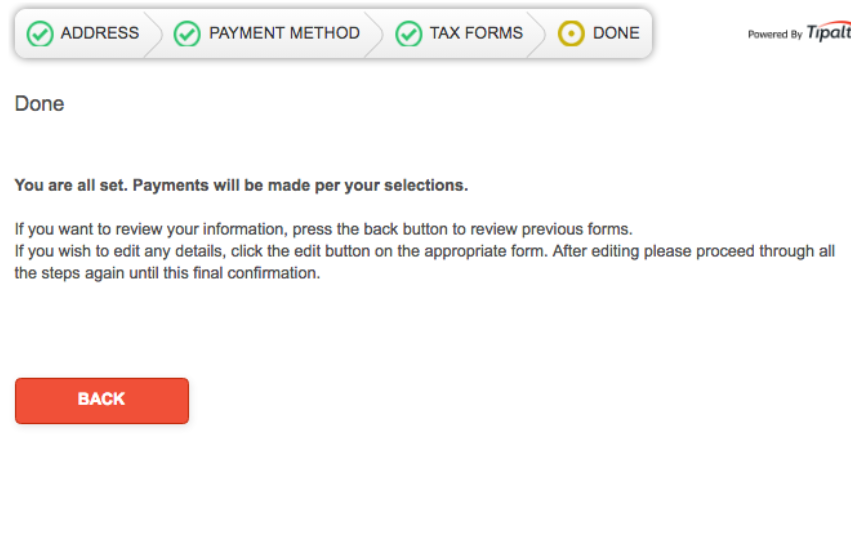

Click Submit Form and you should arrive to the Done page. You are all set. Payments will be made per your selection.

If any information on your W9 becomes incorrect, please submit a new and updated form.

If you are not filing as an individual or have other special cases, please refer to the IRS's W-9 instructions for guidance.

![JUKIN_Logo_WHITE-1.png]](https://help.jukinmedia.com/hs-fs/hubfs/JUKIN_Logo_WHITE-1.png?width=120&height=112&name=JUKIN_Logo_WHITE-1.png)