1042-S Tax Form

Information regarding the 1042-S Tax Form for non-U.S. partners

The 1042-S tax form is a document that reports payments made to foreign persons, including foreign individuals, corporations, and partnerships. As a withholding agent, Jukin Media is responsible for withholding taxes on payments made to international partners and for reporting those payments on the 1042-S tax form.

If you are an international partner who has received a 1042-S tax form from Jukin Media, you may need to use the information on the form to prepare your tax return. You should consult with a tax professional or the Internal Revenue Service (IRS) to determine your tax obligations.

The 1042-S tax form is typically issued by Jukin Media by March 15th, and reports any payments processed the previous calendar year.

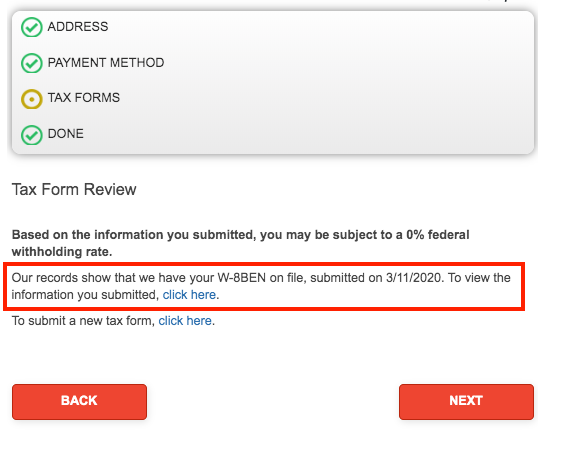

Select "click here" to view the information submitted on your tax form. The last 4 digits of your Foreign Tax Identifying number will be shown.

Select "click here" to view the information submitted on your tax form. The last 4 digits of your Foreign Tax Identifying number will be shown.

Please note: Jukin Media is not able to give advice on how or when you should file your taxes. We recommend that you contact a tax professional with any questions.

If you believe that you should have received a 1042-S tax form from Jukin Media but have not received one or if the information on your tax form is incorrect, please contact Jukin Media to inquire about the status of your 1042-S tax form: partnersupport@jukinmedia.com

![JUKIN_Logo_WHITE-1.png]](https://help.jukinmedia.com/hs-fs/hubfs/JUKIN_Logo_WHITE-1.png?width=120&height=112&name=JUKIN_Logo_WHITE-1.png)